State and local government innovators are experimenting with services that leverage technology-enabled finance.

As innovation creates more opportunities for secure digital transactions, financial technology, or fintech, is taking root in the public sector.

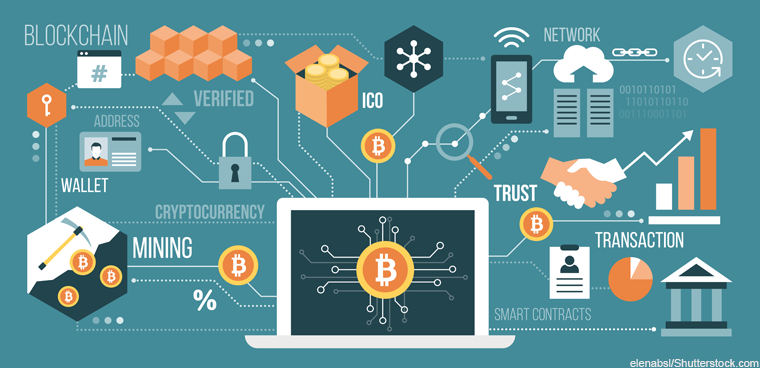

Fintech, which the Brookings Institution defines as “the merger of finance and technology,” covers blockchain and digital ledgers, online marketplace lending, crowdfunding, automated investment advice and initial coin offerings.

Fintech is handled by nontraditional financial institutions, or companies that develop software around banking and payments but are not banks themselves. “Many large, well-established firms involved in data, software, cloud computing, internet search, mobile devices, retail e-commerce, payments, and telecommunications have begun to engage in activities directly or indirectly related to financial services,” according to a July 31, 2018 report from the Treasury Department. “The availability of capital, the large size of the financial services market, and continued advancements in technology make accelerating innovation nearly inevitable.”

These new technologies could let agencies “provide financial services faster, more efficiently, more conveniently, and more cheaply to everyone, including the historically underserved,” Brookings wrote in its 2017 report on fintech in government. Treasury’s report cited the use of fintech by the Education Department for student loans repayment and the Federal Reserve to facilitate retail payments, for example.

OhioCrypto.com is an example of fintech at work in state government. When it launched on Nov. 26, 2018, Ohio became the first state to let businesses pay their taxes using cryptocurrency, a digital currency secured by blockchain and encryption.

“Our goal with launching OhioCrypto.com was two-fold,” state Treasurer Josh Mandel said. “First was to help taxpayers by giving more options and ease in how they can pay their taxes, and second was to plant the flag in Ohio and really project to the rest of the country that Ohio is loud and proud about embracing blockchain technology.”

The state contracted with BitPay, a cryptocurrency payment service provider, to build the site. To use it, businesses register with OhioCrypto.com, enter tax payment information such as the amount and tax period dates and pay with Bitcoin from the cryptocurrency wallet on their smartphone or computer. BitPay converts that into U.S. dollars, which are then deposited into the state’s account.

Users can track their payments in real time, and the blockchain network makes payments transparent to anyone. Twenty-three taxes can be paid via the site, including withholding and public utilities.

“Before we launched OhioCrypto.com, taxpayers could pay their taxes via check, via ACH, via credit card,” Mandel said. “Now they have an added option: paying via cryptocurrency,” which is less expensive for taxpayers than paying via credit card, he added.

Paying taxes by credit card in Ohio comes with a 2.5 percent fee, whereas BitPay collects a 1 percent fee. Currently, it works only with Bitcoin, but there are plans to accept other cryptocurrencies.

Source/More: Government gets ready for fintech — GCN