Last month, something magical happened in Switzerland. The Federal Council issued a report about the legal framework for blockchain technology.

The introduction to the report published on the website of FINMA (the Swiss Financial Market Supervisory Authority) stated that the government wants to establish Switzerland as a leader of innovation and sustainability for blockchain and fintech companies.

In a nutshell, the report shows that, fundamentally, the current legal framework is flexible enough to accomodate innovative business models. The Council has also suggested precise adjustments for any lacking piece within the framework. These modifications are targeted at the enablement of new structures around digital and tokenized assets.

Whilst reading my way through the 170 pages of German, I was positively surprised about the extent and depth of the report. Within the summary, several key topics stood out to me. I share with you my thoughts on them below:

A New Species and the Taste of Disintermediation

First and foremost, there was an announcement about the creation of a new license for exchanges, referred to as a “new authorization category” within the Financial Market Infrastructure Law. Under this new exchange license, a platform operator will be able to list and offer to trade any type of token (also security tokens), host retail and institutional players and enable nondiscretionary, multilateral trading. This would take us 100 light years forward from where we are today.

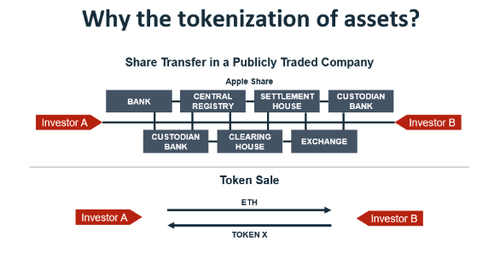

But that is not all. The most important aspect is that it is not a bank, nor a stock exchange, nor a custodian, nor a clearing house. It is all of them, in one!

This is a revolutionary step into the future of financial services and disintermediation, something that does not exist in the current institutional landscape today: a new species.

In the report, this is referred to as a “holistic approach.” Until now, in most jurisdictions we have a sharp separation between exchanges, central custodian and clearing agents. With this new regulation, Switzerland becomes one of the first nations worldwide to recognize the power of distributed ledger technology and to unleash the next massive wave of disintermediation in the financial services industry. The wave that will bring to extinction a lot of institutions that are so dominant and powerful in today’s financial system.

Ownership transfer, off- vs. on-chain. SMART VALOR, 2018

Ownership transfer, off- vs. on-chain. SMART VALOR, 2018

I am very delighted about this new species and even a bit in awe as to it really happening. For years, I used to bring out the chart above and compare ownership transfers of Apple shares vs. Ethereum shares, with a side note: “Now we don’t need all these guys.”

But Wall Street is a power game and those players will not let go easily. They are protected by the legal system that necessitates their existence. However, their days are counted anyway, as the new decentralized and disintermediated order is coming. Because today it doesn’t matter anymore where your company is headquartered or where your customers are.

Business is global and decentralized. This has long been true for most industries: We all use Facebook, Google, Uber and Airbnb. Financial services, though heavily regulated on local levels, is on its way to becoming another global domain. There are already brands that have become truly global, such as Revolut, WeChat, TransferWise, Coinbase and many more. In international business, it does not matter where your company is; your customer base is the world. So you can pick the jurisdiction that provides the most suitable regulatory approach. In fintech, the jurisdiction in which you are based provides a true competitive advantage. It sets the rules. The currencies are digital and borderless; value is becoming the same as well. We are speaking about tokenization and the global internet of value. Who can set the rules there?

This is why we are seeing countries like Japan, Singapore, Liechtenstein, Malta and Switzerland adjusting their legal frameworks. They want this innovation to happen on their turf. They understand that it is a global business and thus, it means global competition. They understand that the next-generation financial market infrastructure has just started to be built up.

Governments and regulators understand that they need to be serious about it, and fast — so they are acting. According to the report, suggestions concerning law adjustments have been ordered to be worked out and submitted to Parliament within the next three months. A real sprint for a Swiss runner.

Source/More: Op-Ed: Switzerland — Full Steam Ahead to Crypto Nation | Distributed