Diana Stetiu is a Romanian law qualified lawyer, holding a law degree and an LLM degree from the University of Paris I: Panthéon-Sorbonne, France.

Diana is a Senior Associate leading the Tech law practice with Bulboaca & Asociatii, she is also a member of the Banking & Finance and Capital Markets team.

Legal Disclaimer:

This article is published as a general overview and, it is not intended to – and should not – be relied upon as legal advice. My references to U.S., Swiss and German law are based solely on consideration of legal principles and not any legal experience on advising clients on U.S., Swiss, and German law.

Question 1: The buzz around STOs is growing. What do you think is their potential?

ANSWER — Anything that is considered today by applicable laws as a security (e.g. shares, bonds, debentures, notes, options, warrants) can be tokenized, therefore, the potential of security token offerings (“STOs”) is huge.

Tokenization is the process of converting rights of any asset into a digital token on a blockchain and issuing the same to the public.

From now on, we will be definitely hearing a lot more about the STOs because they have the potential to become the market standard form of funding for both startups and well-established companies that want to tokenize their securities offering instead of listing them on a stock exchange.

Compared with traditional initial public offerings (“IPOs”), STOs could become IPOs’ real competitor since the costs for an STO remain cheaper.

Also, the companies and investors may prefer digital tokens over conventional securities because trading security tokens in the secondary market through licensed security token trading platforms can be much more attractive for investors who want to quickly liquidate their security tokens.

Security tokens could enable a totally new world of finance where: fees are lower, increased settlement times make deals to be executed faster, market friction is reduced, and securities have more complex structure.

Question 2: Security tokens are asset-backed tokens and represent a claim to an asset. What benefits can an STO provide to the investors?

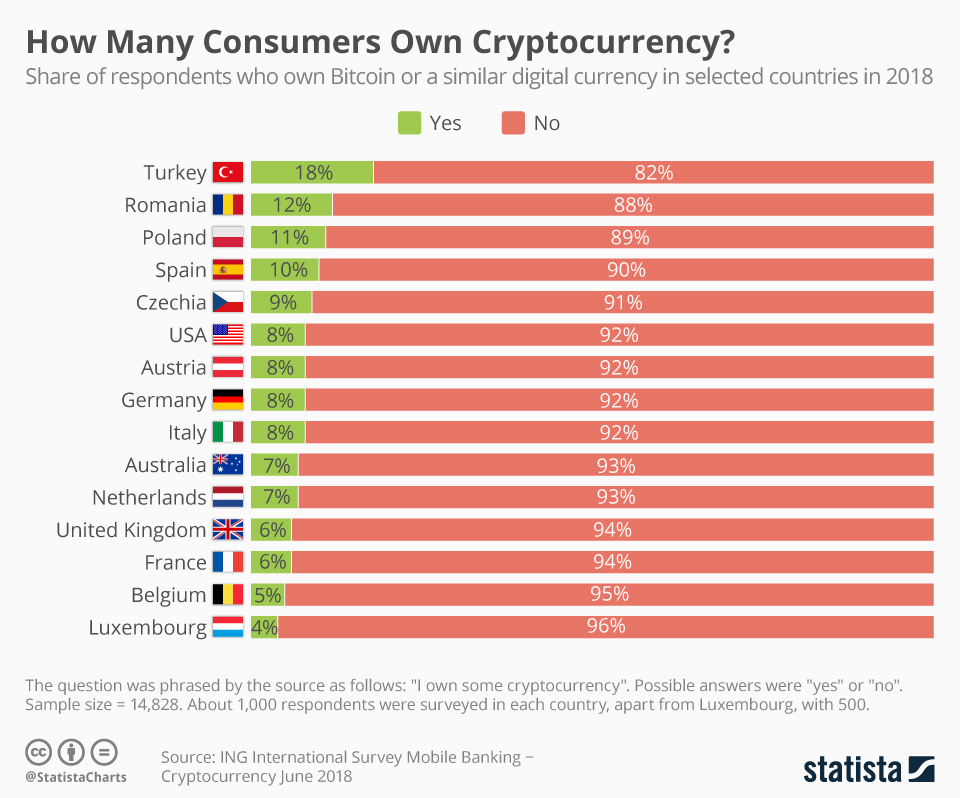

ANSWER — I would point out that nowadays, in the world of cryptocurrency, maybe one of the most pressing questions is how regulatory authorities will treat various digital assets.

It is indeed hard to classify tokens from a legal perspective because there are different economic realities of tokens. A token’s characteristics and the manner in which the token is sold drives the determination as to whether securities laws of various jurisdictions may be applicable.

All regulatory authorities should be aware that the biggest risk is not the lack of regulation, but rather overregulation or bad regulation which may kill the development of revolutionary products.

Within the European space, the Swiss and German regulatory authorities manifested the strongest interest in providing guidelines on classification of the tokens, however, clear guidelines on how to classify tokens or information on when a token will not be regarded as a security have not been yet provided.

Thoughtfulness around STOs increased in February 2018 when the U.S. Securities and Exchange Commission chairman Jay Clayton said: “I believe every ICO I’ve seen is a security”.

Later on in June 2018, the crypto world was pleasantly surprised when the William Hinman, Director for the Division of Corporation Finance of the U.S. Securities and Exchange Commission (the “SEC”) commented on mutability of token treatment, clarifying that tokens classified as securities when they were sold initially for capital raising purposes can later be viewed as non-securities under certain circumstances, particularly if:

(a) “the network on which the token or coin is to function is sufficiently decentralized” and;

(b) “purchasers would no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts”.

According to the Swiss Financial Market Supervisory Authority (FINMA) security tokens named ‘asset tokens‘ represent a specific asset or claim, in particular, a debt claim against the issuer or an equity position/ corporate membership right in the issuer. This makes them broadly similar to traditional securities.

In February 2018, the German Federal Financial Supervisory Authority (BaFin) issued a guidance note explaining the circumstances under which tokens sold via ICOs are financial instruments.

Like FINMA and many other regulatory authorities tackling the ICOs subject, BaFin also took the view that an assessment on a case-by-case basis is necessary in order to determine what a token constitutes if it is:

(i) a financial instrument within the meaning of the German Securities Trading Act or the Markets in Financial Instruments Directive (MiFID II), or

(ii) a security within the meaning of the German Securities Prospectus Act, or

(iii) a capital investment within the meaning of the German Capital Investment Act.

BaFin confined to state that any tradable and negotiable token that is not to be regarded as a payment instrument shall be regarded as a (transferable) security and will, therefore, trigger the respective regulation if it represents any:

(i) shareholder-like claims, or

(ii) contractual claims, or

(iii) any other claim comparable to (i) and (ii).

If the tokens are financial instruments, this means that trading platforms, investment advisers, brokers, portfolio managers or custodians who trade in, advise on, intermediate, manage or store tokens become subject to the MiFID II.

As a consequence, they will need a license and will be supervised by the BaFin.

Source/More: Legal aspects of STOs: An Interview with a Blockchain Lawyer – Legal Marketing