Editor’s Note: During the week, Bill sheds light on all the claptrap and win-lose deals playing out in Washington and on Wall Street. But on Saturdays, we feature a unique essay on an idea outside of our usual fare.

Today, Jeff Brown, Bill’s top technology analyst, reveals what the mainstream media won’t tell you about the future of cryptocurrencies, and shows how the crypto “insiders” are preparing to profit in the years ahead.

The third wave of the blockchain boom is ramping up…

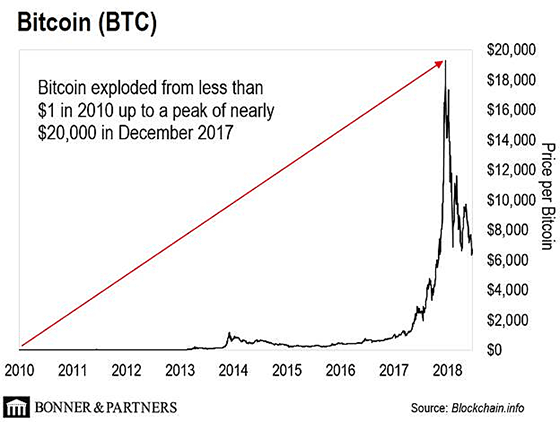

By now, most people are familiar with bitcoin’s massive rise… from less than $1 in 2010 to a peak of nearly $20,000 in December 2017. That was the first wave.

The mainstream press focuses on bitcoin’s price, but that’s not the most important thing about the first wave of the blockchain boom.

What’s important is that bitcoin provides us with something we have not had before – a secure store of value AND an efficient mechanism for transferring value globally on a peer-to-peer basis… all wrapped up in one system.

I cannot stress enough how important that is. Without bitcoin, the next wave of the blockchain boom could not have happened.

Second Wave

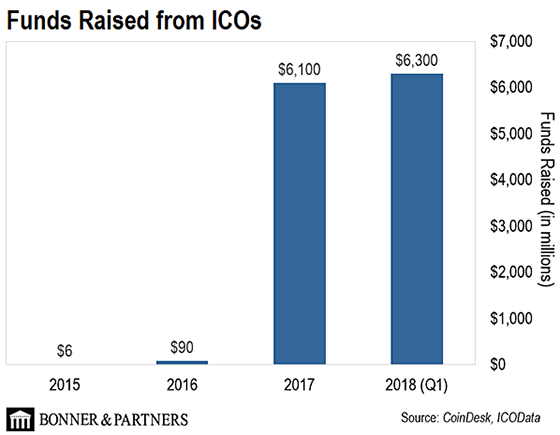

Bitcoin paved the way for the second wave, which was Ethereum and ERC-20 tokens (digital assets that run on an Ethereum blockchain and are compliant with Ethereum’s standards for digital tokens) as a new means of capital formation.

This led to a wave of Initial Coin Offerings (ICOs) in 2017 and 2018, through which blockchain projects raised billions of dollars. The chart below gives you some insight into just how massive this explosion in ICOs was.

As with traditional venture capital funding, many of these ICO projects are ultimately unviable.

But the high-quality projects, projects solving real-world problems in creative ways, will change the world and reach incredible valuations.

Source/More: What a Nasdaq VP told me about the future of cryptocurrencies