Running a successful ICO is becoming more difficult as investors are now warier

ICO funds have poured in at record levels and in 2017 the overall market capitalization grew to over US$130 billion. It seems you can just add the words “blockchain, cryptocurrency, token” and investor dollars will hunt you down. Every day multiple new ICO launches promote their “ERC-20, industry first and get in before we get listed on the exchange” propaganda.

Across the tech world, people want to be “the first” to disrupt and revolutionize” some old-school industry. These dinosaurs have missed the opportunities of information democratization. FOMO (Fear of Missing Out) is rampant and “low-information investors” are screaming “take my money”. It all seems almost too good to be true.

And that is the actual case. Executing a successful ICO is difficult. A lot of things have to fall into place. This is why the majority of these ideas will fail and you will never see an actual working product or service on the market.

According to a recent article in Fortune magazine “Nearly Half of 2017’s Cryptocurrency ‘ICO’ Projects Have Already Died“. And Bitcoin.com found another 113 projects that it calls “semi-failed,” because their teams have gone off the radar or their community has withered away. Add those to the mix and the failure rate jumps to 59 per cent. Nervous yet?

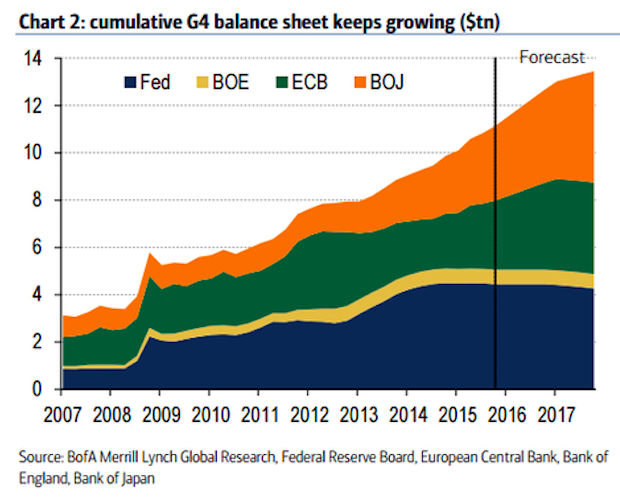

As investors grow wary and scared the flow of funds will begin to shrink. People are getting smarter, earlier. They’re doing more research, sharing information, getting the facts and exposing the schemes, scams and con artists behind these projects.

Regulators are getting more involved in cryptocurrencies and they are starting to prosecute scammers. This will make it more difficult for new ICO projects to achieve PRE-ICO and ICO success.

“The token sale was a blatant rip-off” is what the US Securities and Exchange Commission (SEC) said about PlexCoin, a Canadian digital startup. The company founders, Dominic Lacroix and Sabrina Paradis-Royer, have repeatedly broken securities laws in the past.

But thousands of investors traded US$15 million for the tokens which had no purpose other than to be swapped between people hoping for tremendous returns. The old saying goes “a fool and his money are lucky to get together in the first place.”

Source/More: 7 deadly ICO sins that will scare away your investors