By now, almost everyone has heard of Bitcoin and blockchains. Mainstream news, investment platforms, Wall Street, and everyone else is talking about this technology as the most amazing discovery since the internet. Many have called a Bubble on the Crypto Coins and likened it to Tulip Mania, while others caution about the Dot Com Bubble and how this has the same look and feel of that.

One thing is for certain: There will be some winners in the technology space, and some form of blockchain technology will live on, just like the dot com did. We all still use the internet and dot com companies as an everyday thing. Can we look at the past “dot com bust” and predict the future of blockchain, cryptos and the future of this technology?

I recently attended the MIT Enterprise Forum on building the blockchain ecosystem.

The group of speakers consisted of Lawrence Lerner, (from Rchain), Ryan Strauss (Seattle University School of Law), John Utley (IBM), and Jagan Namani (Madrona Ventures). As the speakers presented, I had a few key questions that I wanted to learn about:

- What’s happening from a regulatory standpoint?

- How is funding done and what are fundamental differences in the blockchain industry that are driving this change?

- What makes a solid business model for blockchain businesses?

- Picks and Shovels vs. Industry solutions – Which drives adoption faster?

I was excited to hear about what IBM was doing in the space, especially because of my curiosity around Stellar Lumens and the IBM CryptoCoin. John Utley from IBM spoke about all of the various ways IBM Blockchain technologies are finding ways to deal with supply chain at Boeing as well as many other companies. On Tuesday, IBM announced it teamed up with the world’s largest container shipping company, A.P. Moller-Maersk, to provide a new platform for conducting global trade using blockchain technology. We tried to get John to share more about Stellar Lumens and some of the banking partnerships IBM has in the South Asia Pacific region, but unfortunately the event ran out of time to get the answer. Hopefully people following IBM will learn more on their next earnings calls.

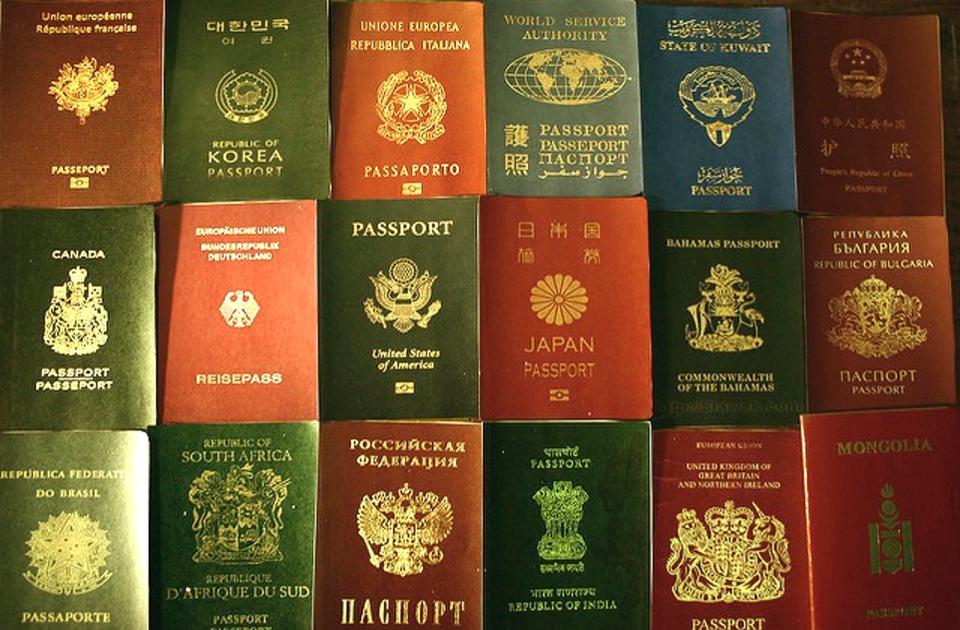

From the question on what’s happening from a regulatory standpoint, I think there are some insights that were given, but we still are so early on in some of the technology that it’s mere speculation. This week, similar to January 2017 and 2016, the crypto market had another big rollercoaster ride. Fears that the Korean government are starting to regulate crypto currencies as well as China and Russia may have played into the large price drop in crypto currencies. Some of the discussion that did shed light on this is how some companies are now starting to look at smart contracts using blockchains. There’s still no legal established practices in the U.S. today for this, however, we may see some of these changes for blockchains establishing trust in legal frameworks.

One of the more interesting topics that came up during this event was the idea of digital voting using Blockchain. There is a whitepaper from Plymouth University that talks about how voting could be changed and much more secure using a blockchain.

Voter registration could be tied to unique cryptographic addresses for each voter and upon proof of identification and the voter registration QR code, voting could be done with a web browser or at any polling station. The possibility of having voting records on a public blockchain and no longer using paper ballots could be a great reduction in error, voter fraud, and attacks on the voting platform itself.

Source/More: A Review of the MIT EF Blockchain Presentation | Radware Blog