The world is going crazy for Bitcoin. These two things need to be done, for the good of Bitcoin.

The world has officially gone insane over Bitcoin and millions are rushing to buy it. There are a couple of things that need to be said, now more than ever. Let’s get straight to the point.

1. Take ownership of your Bitcoins

Trust nobody.

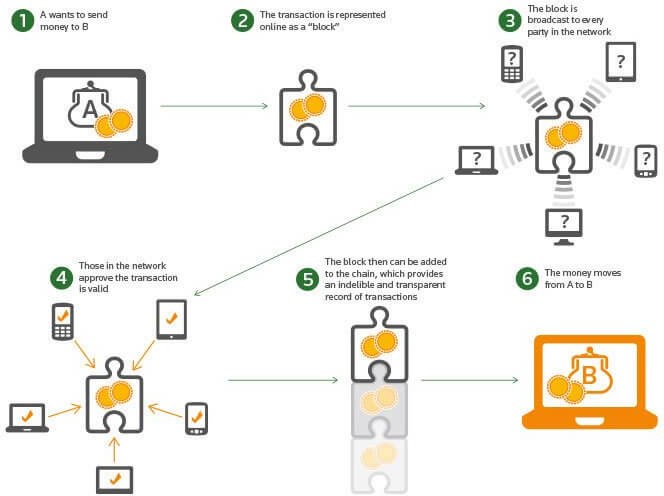

That is the name of the Bitcoin game. Bitcoin works because when it comes to keeping track of who has how many coins or who sent how many coins where, neither you or I have to trust each other, or trust a central entity.

It also works because we don’t have to trust a central entity, like a bank, to hold our coins. Your coins are yours alone, provided you hold the private key to your Bitcoins.

Time and time again, even the most tenured Bitcoin hodlers have ignored this adage and suffered the consequences.

Unsurprisingly, the use of centralized exchanges that facilitate the sales of Bitcoin has coincided with Bitcoin’s growth and gone parabolic. With this rise in exchange usage, this message needs stressed upon now more than ever.

There’s no measuring just how many people using exchanges to buy Bitcoin are keeping their coins on these exchanges for extended periods of time, short of asking exchanges for the numbers themselves. But as long as that number keeps rising, a larger and larger target is painted on these services’ backs. The potential damage (or payday, depending on how you want to look at it) from a successful attack on any of the countless crypto exchanges also rises accordingly.

For those who don’t know, leaving your coins on an exchange does not mean those coins are yours. You are simply trusting the exchange to release them to you at some point if you so request it. You have no idea of what level of security these exchanges deploy, nor should you trust any security they report to have. Your coins are stored in a trust-maximized and centralized entity, almost entirely defeating the purpose of using Bitcoin.

If you’re not convinced that keeping your coins on an exchange is a massive problem, here are just a couple of horror stories to help you along.

The timeline starts with Mt. Gox, the world’s most popular exchange at the time. In 2014, it was the target of one of the first major cryptocurrency heists — 850,000 Bitcoins (over 4% of all Bitcoins that will ever exist) were stolen from Mt. Gox. Bitcoin’s price then proceeded to plummet in the following year as a result.

Source/More: Bitcoin owners, you need to do these two things right now