Preface

February of this year, I tweeted a chart that presented the idea of a PE ratio for Bitcoin, something I temporarily called MTV Ratio before my buddy Chris Burniske suggested the less confusing term of NVT Ratio (Network Value[1] to Transactions Ratio). Later in May, Chris was the first to present NVT Ratio at Token Summit 2017. Subsequently, this ratio has been mentioned in blog and media articles across the web. In my original tweet, I promised an article; it lay unwritten until now.

The idea behind NVT Ratio

In traditional stock markets, price-earnings ratio (PE Ratio) has been a long standing tool for valuing companies. It’s simply the ratio of a company’s share price to its equivalent earnings per share. A high ratio describes either over valuation or a company in high growth.

What would be the equivalent in Bitcoin-land? We have a price per token, but it’s not a company so there are no earnings to do a ratio. However since Bitcoin at its essence is a payments and store of value network[2], we can look to the money flowing through its network as a proxy to “company earnings”.

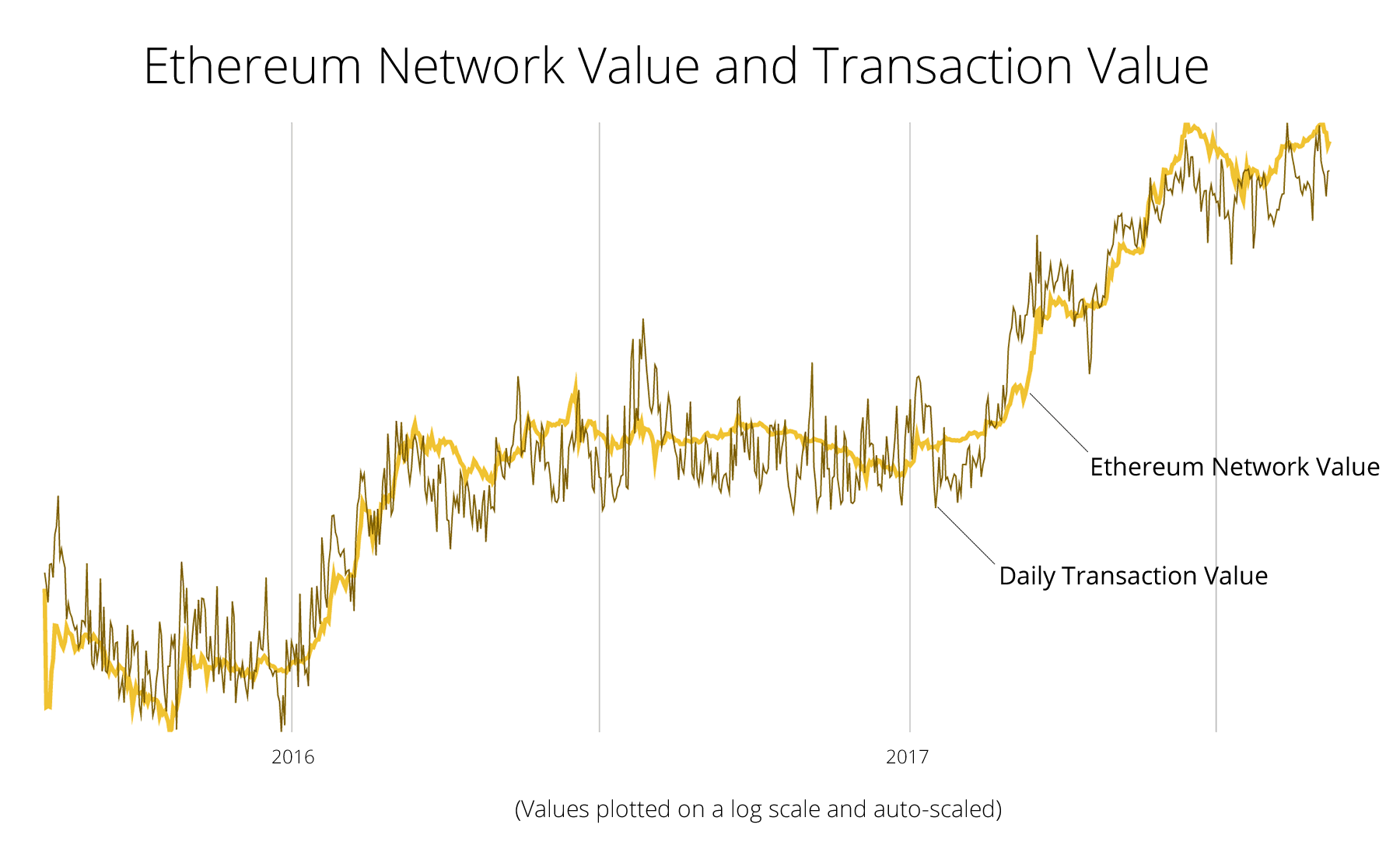

As you can see the value transmitted on the Bitcoin blockchain is closely tied to its network valuation. The idea that we can use the money flowing through the network as a proxy for network valuation is valid.

We can express this as a ratio. I call it NVT Ratio, short for Network Value to Transactions Ratio. Below is a historic chart of Bitcoin’s NVT ratio. A live and interactive chart is available on my site at Woobull.com.

Source/More: Introducing NVT Ratio (Bitcoin’s PE Ratio), use it to detect bubbles