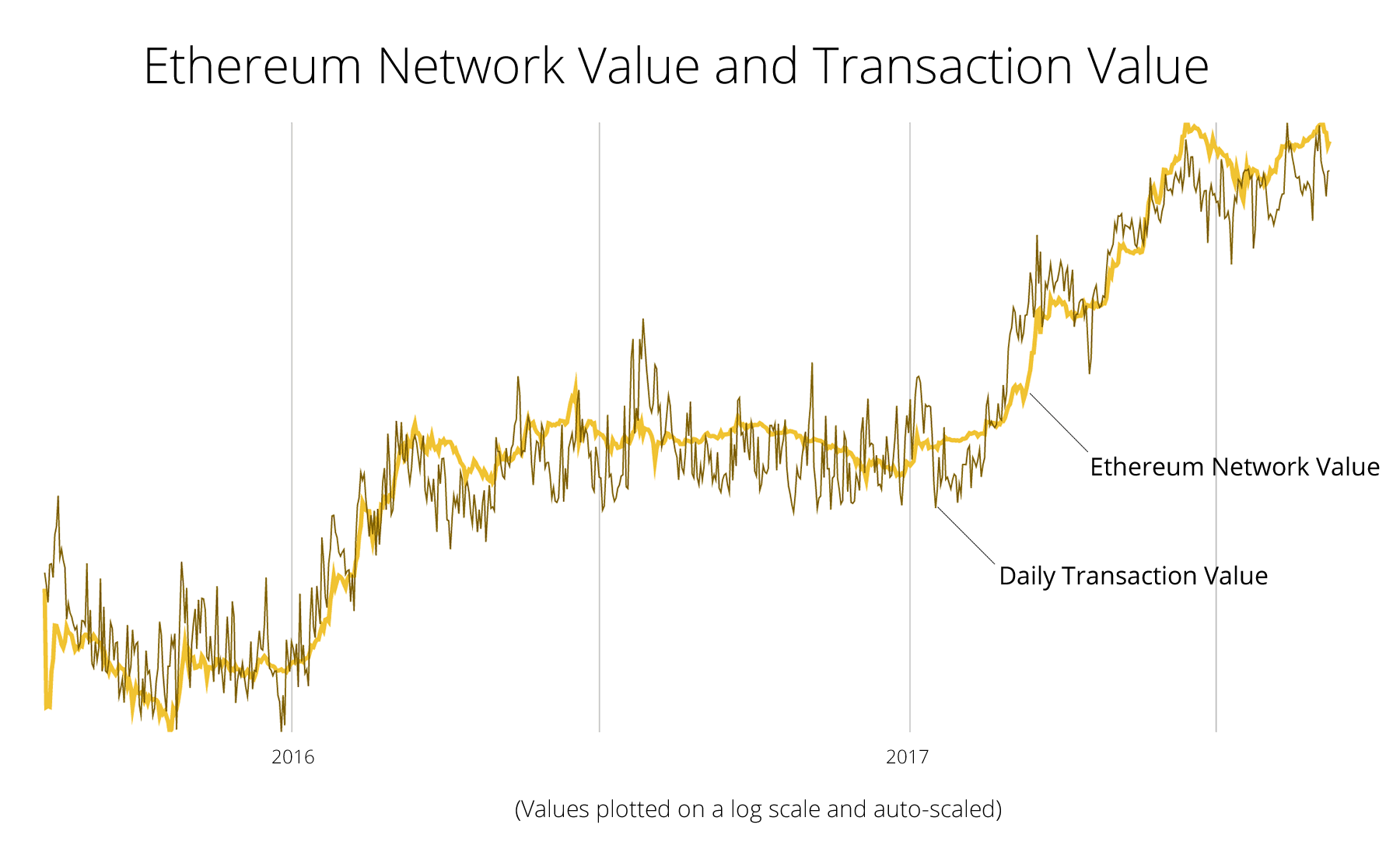

Cryptocurrencies have soared in popularity since 2008, with more than 1,000 in existence today and an aggregate value greater than the market capitalization of IBM. But we are highly doubtful whether they will ever become mainstream currencies. The need for companies and individuals to pay tax receipts in government-issued currency, and the potentially unlimited crypto-money supply, pose significant barriers to widespread adoption. We think the sharp rise in crypto-currency valuations in recent months is a speculative bubble.

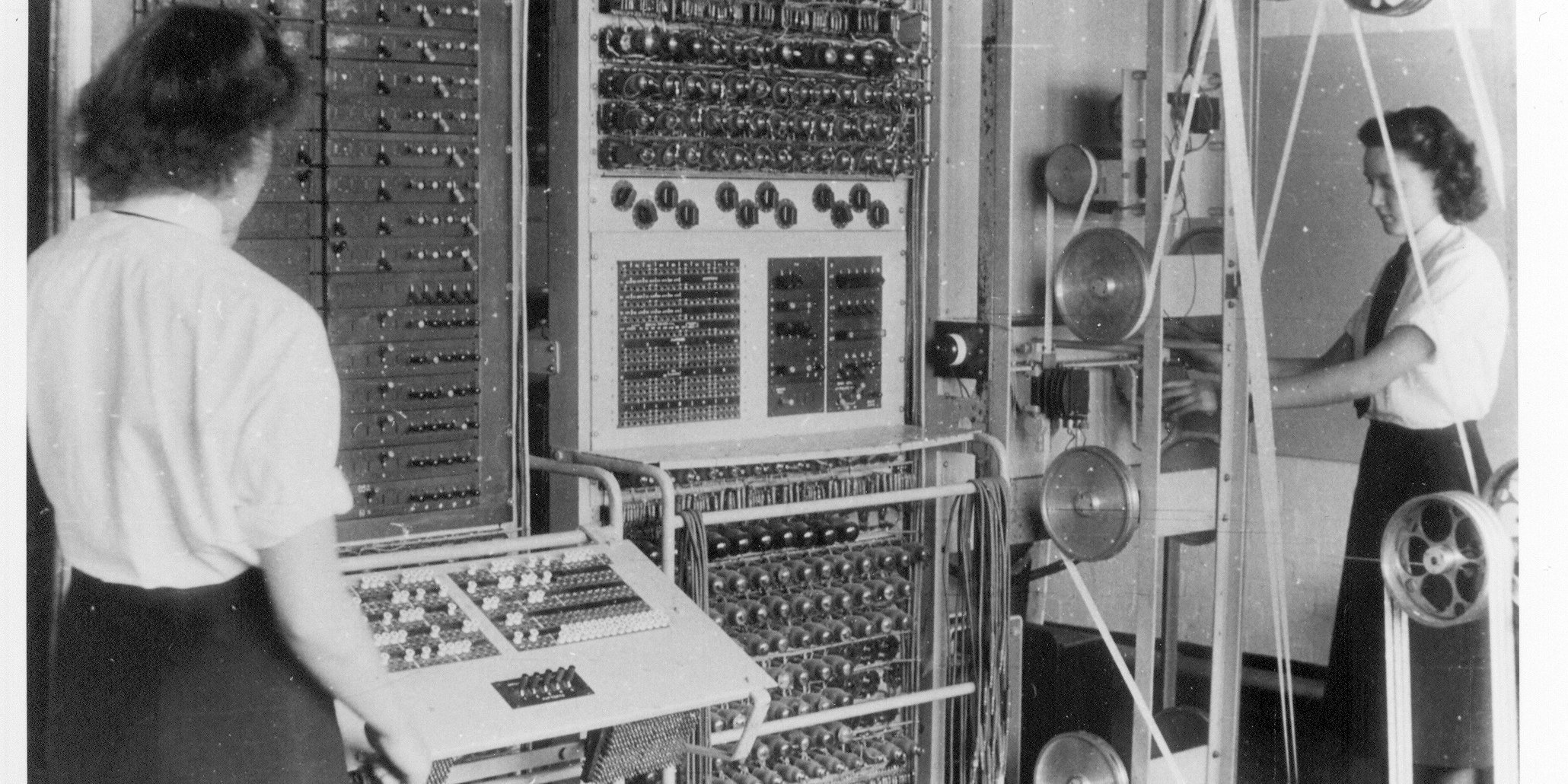

But while we are doubtful cryptocurrencies will ever become a mainstream means of exchange, the underlying technology, blockchain, is likely to have a significant impact in industries ranging from finance to manufacturing, healthcare, and utilities. We estimate that blockchain could add as much as USD 300-400bn of annual economic value globally by 2027.

Investing in the blockchain wave is akin to investing in the internet in the mid-nineties. Blockchain could lead to significant disruptive technologies in the coming decade. But for the time being, technological shortcomings still need to be resolved, it remains unclear which specific applications will prove most useful/profitable, and actual revenue and profitability associated with the industry is currently limited. Despite these challenges, investors seeking long-term opportunities from blockchain technology can start to position in two broad groups: technology enablers – in software, semiconductors, and platforms; and early & successful adopters – in finance, manufacturing, healthcare, utilities, and the sharing economy.

Source/More: Cryptocurrencies – Beneath the bubble | UBS Global topics